On Golden Ponds.

How are Trusts and Foundations ageing out? What we can learn from The List. August 2024

Introduction

We know that charities have never been in more demand, but rarely have they found it so hard to raise funds for their causes.

There have been many challenges over the last decade or so - the financial crash and credit crunch, local government cuts and austerity, through to the pandemic and cost of living crisis, not to mention the recent race riots[1]- sometimes described as a “poly-crisis” - each uniquely shifting the fundraising landscape.

However, earlier this year, fundraisers and grant writers across the charity sector started to notice more and more trusts and foundations making announcements to spend out, close their doors to new or unsolicited grant applications, or pause their application processes.

We therefore started The List[2]: a collaborative record of trusts and foundations changing their practices. The spreadsheet has helped establish an open debate that has highlighted a number of trends - from those managing huge volumes of applications to those not opening grant windows at all.

A range of pressures within the system are coming together to create a perfect storm for grant writers and the charities they support, most of whom are small[3].

Context

Grant making represents an estimated 14-22% of the charity sector's income[4]. While this may seem like a relatively small portion overall, it's a critical source of funding for many organisations, often representing the majority of income for some.

It has to be recognised that many charities operate for causes and for communities where trust and foundation grants will continue to be the dominant source of income, but they now face competition.

The impact of the reductions in local government grants as a major source of income[5] (NPC estimates that charities are propping up public services to the tune of £2.4bn each year. The median amount a charity receives from the government for its service is 65% of the value of the contract), the rebalancing of trust and foundation giving post-pandemic, and the shift away from community and events fundraising also caused by the pandemic, are being felt by the increase in attention on trust and foundations as a source of income.

The UK charitable trust and foundation landscape is dynamic and growing, with over 10,200 existing foundations and more than 100 new registrations in both 2021 and 2022[6]. In 2022-23, approximately 13,000 UK grant makers distributed over £20 billion in grants[7]. The top 300 foundations reached a record high of £3.7 billion in grant making for 2020-21, showing strong real-terms growth of 13% from the previous year.[8]

Despite the apparent financial health of many trusts and foundations, there is growing concern about the wider charitable sector's resilience. The Charities Aid Foundation's Charity Resilience Index[9] found that less than a third of charities were highly confident in their funding in January 2023, with more than half worried about their survival.

Just last week Pro Bono Economics (PBE) and Nottingham Trent University’s VCSE Data and Insights National Observatory reported that almost 6 in 10 (58%) charities surveyed are facing financial difficulties and have dipped into their reserves unplanned, while a further 23% have renegotiated existing contracts and grants. A number of open responses also noted that their organisations have revised their fundraising strategies[10]

Despite the apparent wealth of the trust and foundation sector as a whole, fundraisers are finding their success rates falling. This discrepancy between statistical data and on-the-ground experience highlights the need for a deeper understanding of the current state of trusts and foundations in the UK.

Key Points

Growth and stability: Grantmaking expenditure has shown steady growth since 2013, with three distinct growth phases since 2004[11]. Most foundations have maintained stable grantmaking levels, with family foundations and general grantmakers increasing their giving in 2022-23.

Conservative spending: Foundations typically spend a small percentage (1-5%) of their endowments annually, with an average payout rate of 3.2%. This conservative approach aims to balance current giving with long-term sustainability[12].

Asset-grantmaking relationship: There isn't always a direct correlation between net assets and grantmaking. Some foundations with smaller asset bases grant more than those with larger assets, indicating varied approaches to philanthropy

Concentration of resources: The top 100 general grantmakers hold significant resources, with collective net assets of £61.6 billion and annual giving of £2 billion. However, there's a notable drop in grantmaking amounts after the top few foundations, suggesting a concentration of resources among a small number of very large foundations.

Operational struggles: Most foundations operate with small teams, with 59 out of the top 100 foundations reporting five or fewer employees.

Varied spending rates: Family foundations spend about 3.39% of their net assets on grantmaking, while general grantmakers spend approximately 12.14%.

Sector growth: Family foundations increased grantmaking by 11%, while corporate foundations saw a more substantial increase of 17% from the previous year.

Inflation challenges: In 2022, only about 41% of foundations increased giving by at least 8% to keep pace with inflation. The median increase was 4%, suggesting that many foundations struggled to maintain their grantmaking power in real terms.

Grantmaking reductions: Some foundations significantly reduced their grantmaking spend in 2022-23.

About trusts and foundations

Using UK Grantmaker headings[13], we'll take a look at the four broad categories and their performance during 2022/2023.

Independent charitable trusts and foundations

General, often social purpose, grant makers, including organisations like Henry Smith Charity and City Bridge Foundation, which have shown significant increases in grant spending, are often those who would describe themselves as “engaged” funders. They seek to develop positive relationships with the charities they support and to be more open and transparent in their decision-making. The top 100 general grant makers collectively hold net assets of £61.6 billion and distribute annual giving of £2 billion. The Henry Smith Charity, giving grants across the UK, was the largest, with £65.2 million in grant spending. City Bridge Foundation - London-only - was second with £60 million. Other major grant makers included Sequoia Trust (£55.3 million), Surgo Foundation UK (£55.3 million), and Grace Trust (£48.7 million). A few new entrants to the list had very large percentage increases, likely due to newly established funds or changes in giving strategy. The Albert Gubay Charitable Foundation increased grant making by 151%, from £4.03 million to £10.12 million (2021/2022-2022/2023). (Net Assets £606.007683m YE March 2023)

Conversely, there are a further 10,226 small trusts and foundations with spending only £1.9 million between them.

However not all these large, independent grant makers are open enough to public their data. Only 13 of the top 100 are listed as "360Giving Publishers", indicating they openly share data about their grant making.

The Henry Smith Charity and the City Bridge Foundation have announced their pausing of some of their major grant programmes in the last two months, and the Albert Gubay Charitable Foundation is now closed for the remainder of the financial year. The City Bridge Foundation has also changed eligibility criteria since pausing their programmes.

Family Trusts & Foundations

Family foundations, such as the Garfield Weston Foundation and Paul Hamlyn Foundation, play a substantial role in the sector. The top 100 family foundations collectively hold £39.5 billion in net assets and distributed £1.65 billion in grants. While family foundations increased grant making by 11% overall, there is significant variation within this group, with some foundations substantially increasing their giving and others reducing it. This group is equally varied in its approach to openness and transparency, with some publishing their data and seeking to improve relationships with the charities they support, while others are only researchable by examining accounts listed on the Charity Commission website.

Total grant making of the 100 largest foundations decreased by less than 1% overall which is -9% in real terms (when adjusted for inflation). Thirty funders decreased their funding – four of them by over £10 million each including 29th May 1961 Charity. The top 10 foundations account for 57% of the total grant making. On average, foundations spent about 4.2% of their net assets on grant making.

69 funders increased their funding including.

Rank Foundation Limited 16.119 increase 38%

Thompson Family Charitable Trust 14.33 increase 62%

Garfield Weston Foundation 89.459 increase 1%, with endowments steady

Paul Hamlyn Foundation 39.614888 increase 5%

Wolfson Foundation 38.13069 2% increase

Jane Hodge Foundation 5.9581 120% increase

Albert Hunt Trust 7.2416 increase 18%

It is worth noting that the Tudor Trust remains closed for applications, the Albert Hunt Trust is spending out, and the Paul Hamlyn Foundation paused one of its funding streams only for it to received more applications in the first two months than they usually do in a year. The Gatsby Charitable Foundation does not accept unsolicited applications. We assume a high level of applications to the Garfield Weston Foundation because they are one of the only unrestricted, core grant funders open at the moment[14].

Update the Esmée Fairbairn Foundation increased their grantmaking from £36.2m in 2022 to £57.3m in 2023.

Fundraising Foundations

In contrast to the categories described above which derive their grant making funds from investment yields, fundraising foundations depend on regular consistent giving. They include well-known publicly subscribed names like Comic Relief and BBC Children in Need, who have faced challenges recently. Overall grant making from these organisations decreased by 1.4% (or 10% in real terms when adjusted for inflation). National Lottery distributors, another fundraising organisation, which are crucial sources of sector funding, reduced their grant making by 13% overall in 2022-23.

The top 5 foundations by grant-making spending are:

BBC Children in Need: £62.25 million

Comic Relief: £25.24 million

Association of NHS Charities: £18.06 million

Postcode Planet Trust: £14.77 million

Postcode Earth Trust: £14.62 million

These top 5 foundations account for about 39.5% of the total grant-making spending among the 50 listed organisations.

Comic Relief experienced the largest decrease in grant-making at -61.6%, has undergone a strategic review and currently does not have any grant windows open. Children in Need has also undergone a strategic review. They currently receive three times more ‘Expression of Interest’ requests than they are able to invite to submit a full application. Of those invited to submit a full application 1 in 2 get funding. This means that only 16.5% of all initial EOI submissions ultimately result in funding.

Corporate Foundations

Corporate foundations saw robust growth, with an increase of 17% in grant making from the previous year. The top 50 corporate foundations collectively distributed approximately £569.7 million in grants, with organisations like Quadrature Climate Foundation and Corra Foundation leading in grant spending.

Corporate foundations in the UK play a significant role in charitable giving, with the top 50 foundations collectively distributing approximately £569.7 million in grants. The top 5 foundations by grant-making spending are:

Quadrature Climate Foundation: £120.50 million

Corra Foundation: £44.53 million

Goldman Sachs Gives (UK): £35.48 million

AKO Foundation: £34.60 million

Premier League Charitable Fund: £31.28 million

These top 5 foundations account for about 46.7% of the total grant-making spending.

Show me the Money!

Based on the provided data, these are the top 10 foundations by grant making spend in the UK - the important corollary being that they are not all equally accessible for charities and their fundraisers. Neither are they equally open about their decision-making processes:

Children's Investment Fund Foundation (UK): £396.97 million - does not normally accept unsolicited proposals

Gatsby Charitable Foundation: £134.54 million - does not normally accept unsolicited proposals.

Quadrature Climate Foundation: £120.50 million - has very specific priorities

Leverhulme Trust: £95.96 million - most schemes are currently closed within a very specific priorities including academic and research activities

Garfield Weston Foundation: £89.46 million

Henry Smith Charity: £65.23 million - two major programmes under review and currently closed to new applications, not due to re-open until Spring 2025

BBC Children in Need: £62.25 million - under pressure from high demand

City Bridge Foundation: £60.00 million - major programmes closed to applications

CH Foundation (UK): £69.70 million - this foundation does not appear to have an open application system nor publicly available information about their grantees

Sequoia Trust: £55.34 million - does not have a publicly disclosed grant process

What we can see from the grant making side is a more proactive stance with many funders never open or currently closed to unsolicited applications.

Sense and Statisticability - learning from The List

Whilst the statistics point, in the main to, a relatively healthy grant-making sector, for fundraisers this is far from what is being experienced.

The common theme from The List is that the shifting trust and foundation decisions are recent - within the last 18 months - and are often sudden and unanticipated, with changes deviating from their regular funding cycle.

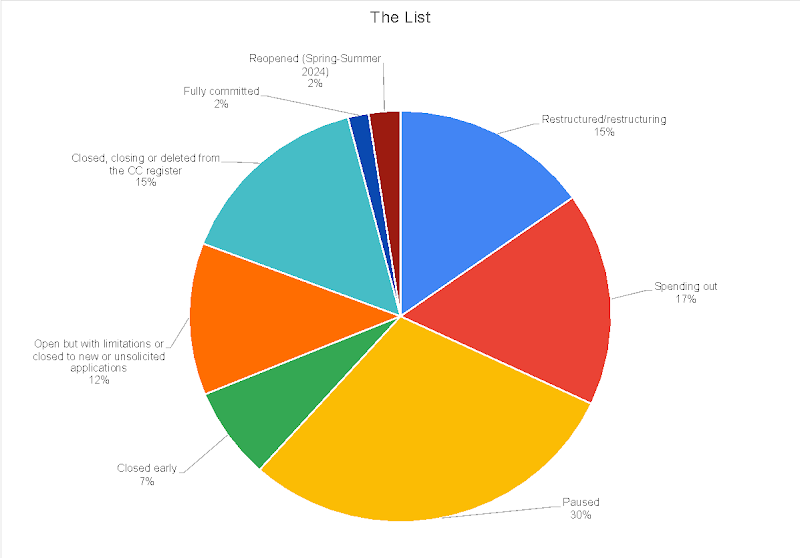

There are now over 130 trusts and foundations on The List categorised by behaviour - restructuring, spending out, funds fully committed, paused, closed, or open but with significant limitations (mainly invitation only).

During the time The List has been running (March - August 2024), only three funders have reopened or reverted to their “normal” practice, including the Paul Hamlyn Foundation and the James Tudor Foundation.

Whilst every fundraiser would acknowledge that funders from time to time seek to adjust their giving strategies in response to changing external trends and internal interests, with The List we have been able to identify other trends and pressures that impact significantly and sometimes negatively on their work. Sometimes these aspects conflate, adding further pressure.

For example, in May 2024, the Henry Smith Charity announced it was closing two of its largest thematic programmes - Strengthening Communities and Improving Lives - with 6 weeks’ notice. The result was a 3000% increase in applications as charities rushed to submit before the deadline rather than wait another year.

An analysis of The List illustrates two major and interconnected themes. There are possible overlaps between them - suggested by closed and restructured trusts and foundations forcing fundraisers to look elsewhere for support and pushing applications towards those that are left.

As The List so eloquently sets out, many smaller trusts are feeling overwhelmed with applications and don’t have or use enough resources to manage their processes. Very nearly 50% of the funders listed have either paused, closed early or remained open but with serious limitations (in a way that is unusual for them), In the time we have been compiling The List, this trend has accelerated.

“Due to the unprecedented interest in the Fund and a significant volume of applications, we have taken the difficult decision to close to applications from UK-wide projects while we review the trust's funding strategy for FY25. Our August 2024 application window will only open to new applications from projects supporting the community of Nottinghamshire. We'd ask that you review our giving policy prior to making an application. Please note, we have made a change to this recently. If you are an organisation with significant large reserves, specifically over £1m, your application will not be considered as the Trustees look to prioritise funding for organisations with fewer resources”

A number of trusts set up from legacies in the 1980s & 1990s are now coming to their natural end having spent their funds and achieved their objectives. The Foyle Foundation, for example, was established to distribute funds from the estate of the late Christina Foyle. It was designed to spend out over 25 years which ends in 2025. However, in that time, they have become a significant open application grant funder so its ending will leave a gap in many prospect lists.

A small but significant number have made a strategic decision to spend out in response to the current poly-crisis to shore up their chosen causes for later.

"With the unprecedented recent effects on society, through the pandemic and current cost of living crisis, there is a stark increase in the dependence being placed upon civil society as a source of intervention. With the acknowledgement that there is much immediate need for financial support the Trustees have decided to act now by concentrating on the spending of the Trust’s remaining resources within a specific timeframe."

Finally, there is the small group – of which the Lankelly Chase Foundation is the most high-profile – which have acknowledged that they are part of the problem rather than the solution to structural inequalities. They would rather shift away from the traditional “invest capital to spend yield on grants” model and find an alternative, more equitable model of supporting systems change. Trustees of the Lankelly Chase Foundation claim they are engaged in a radical redistribution of resources in recognition of the "harms" done by traditional philanthropic practice - so they suggest they are not "spending out" rather facilitating flow of resources more directly to social justice practitioners. Shifting investment more directly to alternative models and owners as a challenge to traditional barriers between how money is earned and how it's spent

"This decision was taken in large part due to the sense of urgency we felt, in recognition of the imminent dangers of the climate crisis. We also recognise the Foundation’s complicity in the collective harms done by the many forms of capitalism."

Conclusion

While the overall financial health of the sector appears robust - the spend in comparison to available assets actually suggests a cautious approach in the face of changing circumstances - the experiences of many foundations, fundraisers and charities point to a more precarious situation.

Grants still matter - not all charities can diversify their income streams - but neither are they a “quick fix” when other fundraising practices are under strain. There is intense competition for grant funding at a time when charity’s resources are scarce with many of the top grant-making foundations not easily accessible, requiring changes to traditional approaches.

The real-term value of grants has also been eroded by inflation and fundraising teams are under immense pressure. Adapting fundraising strategies, pivoting to address short application windows, and developing pipelines require good intelligence, networking and understanding of the context within which we all operate. Especially as circumstances often change, exemplified by a recent statement by a trust;

‘Over the last few years the Trustees have been looking to spend down the Foundation’s capital endowment but have recently decided to discontinue the spend down programme. Grant-making priorities are currently being reviewed and refined in the light of this decision’

We hope that users and contributors to The List will continue to build our body of knowledge and understanding. We hope to use this note and the list as a basis for further advocacy and the start of more conversations and understanding within charities and between grant-seekers and grant-funders. (Hi)

As the wonderful Nicola Upton said “In a tough landscape, knowledge is power”.

Authors

Jo Jeffery, Full Circle Consultancy, and Emma Collier, Chora Consulting

Side note

Jo has met with ACF, NCVO and CIOF and will meet Billy Bruty in September to discuss the impact and development of these trends. Bill Bruty will be updating his ‘fishtank’ research shortly - so expect updates to come!

And there’s more …

We will also write about a brighter future for grant making in the next briefing note.

Disclaimer

AI was used to analyse information from UKGrantmaking and summarise findings as well as to assess the writing for flow, clarity, and ease of reading.

Further Reading

UNDERFUNDED AND OVERLOOKED | The Centre for Social Justice

The Brutal Facts — Fundraising Training Ltd

Things do not seem to be improving. - SCVO

State of the Sector 2024: Ready for a reset - NPC

UK Civil Society Almanac 2023 | NCVO

References

[1]https://www.linkedin.com/posts/civil-society-media-ltd_foundations-issue-emergency-funding-in-response-activity-7231625764561993728-3xiZ/?utm_source=share&utm_medium=member_android

[2] Trust and Foundations List - Paused, Closing, Under Review , Other

[3] (under £500k)

[4] https://www.ncvo.org.uk/news-and-insights/news-index/uk-civil-society-almanac-2023/financials/

[5]https://www.thinknpc.org/resource-hub/state-sector-2024/

[6] FOUNDATION GIVING TRENDS 2022

[7] https://www.threesixtygiving.org/2024/06/24/explore-ukgrantmaking/

[8]https://acf.org.uk/acf/acf/Newsfeed/2023/Grant-making-by-foundations-increased-to-a-record--3.7bn-as-demand-grew-sharply-in-2020-21.aspx

[9] https://www.cafonline.org/insights/research/charity-resilience-index

[10] Treatment for the charity sector’s unhealthy status quo

[11] https://www.fundraisingtraining.co.uk/brutal-facts

[12] https://www.ukgrantmaking.org/

[13] UKGrantmaking.org collates data from regulators, funder accounts and data published using the 360Giving Data Standard to provide an interactive platform for understanding grantmaking in the UK.

[14]https://www.civilsociety.co.uk/news/major-foundation-assets-grow-by-over-1bn.html

Support our writing

This note took us months to create. It’s totally free for you to enjoy but if you like what we have done you can help us in a few different ways:

You can share our musings

For Jo you can subscribe to Circles for free but you can also become a paid subscriber for £5/mo. This would help fund me to write articles more often!

You can keep me caffeinated and buy me a virtual coffee here.